Sales Return allows businesses to manage product returns, update stock, and record refunds or credit adjustments. 🚀📦

📌 Two Ways to Process a Sales Return in BillBook #

✅ First Way (Recommended – Editing the Invoice Directly) #

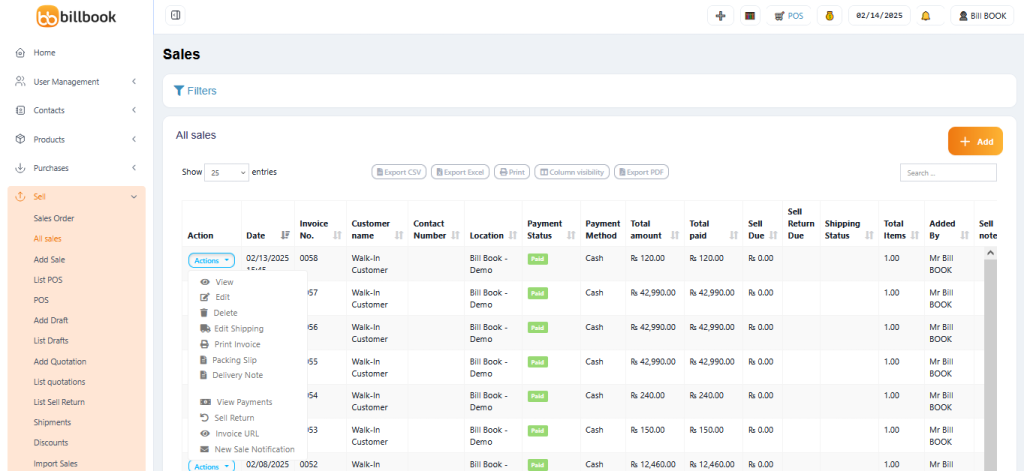

✅ Go to → Sell → List Sales

✅ Find the invoice for the sale that needs to be returned/adjusted.

✅ Click “Edit Invoice” ✏️

✅ Remove the returned product or reduce the quantity.

✅ Click “Save” 💾

📌 What happens next?

- The returned quantity is automatically added back to stock 📦

- The sales record updates to reflect the return 🔄

✅ Second Way (Manual Sales Return Entry) #

✅ Go to → Sales Return Section

✅ Add the returned product, quantity, and reason.

✅ Process the refund or issue store credit as needed.

📌 This method is useful when managing complex returns separately from the original invoice.

❓ Why Doesn’t the Sales Return Reduce Payment from the Parent Invoice? #

BillBook tracks returns separately in financial reports for better accuracy.

📊 How is it Adjusted? #

- Profit & Loss Report: Sales returns are automatically adjusted.

- Payments Handling:

- Users must manually record the refund/payment adjustment.

- Go to Transactions and add a refund entry for proper tracking.

📌 This ensures that all transactions are correctly recorded and reflected in financial reports.

🚀 Why Use BillBook’s Sales Return Feature? #

✅ Automatically updates stock when returns are processed 📦

✅ Provides clear records for refunds & adjustments 💰

✅ Ensures accurate reporting in Profit & Loss statements 📊

✅ Allows easy editing of past invoices for quick return processing ✅

With BillBook’s Sales Return feature, managing product returns is simple and efficient! 🚀🔄

Let me know if you need any refinements! 😊